How America's Frontline Workers Are Bracing for a Recession

As talk of a potential recession grows louder, the workers most likely to feel its first impacts are already making moves to protect their livelihoods. From truck drivers and tradespeople to retail clerks and healthcare aides, frontline workers in hands-on industries are adjusting their finances, work hours, and long-term plans. Our survey of 844 workers in fields like transportation, hospitality, healthcare support, and construction reveals how these essential professionals are bracing for economic uncertainty.

Key Takeaways

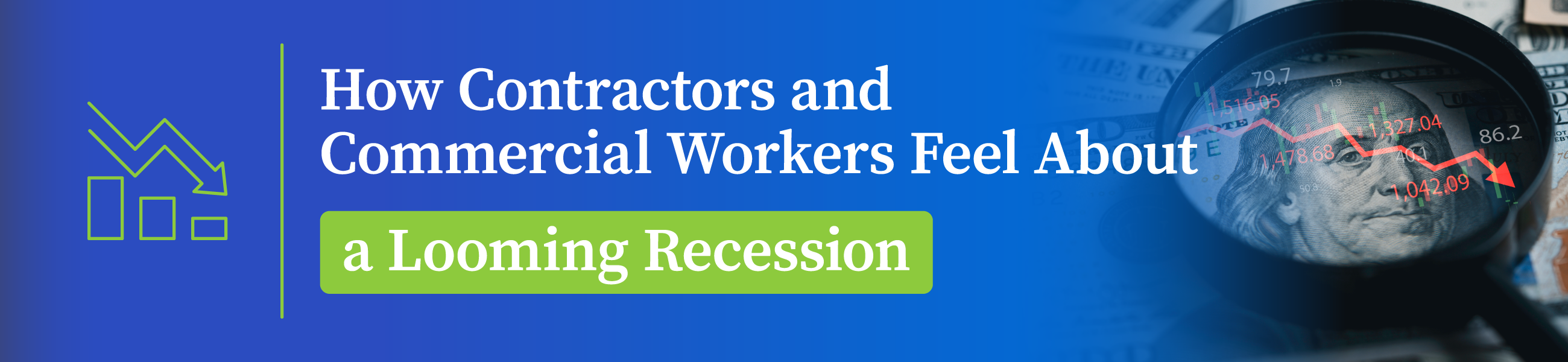

- 67% of frontline workers are concerned about their job security due to a potential recession.

- 68% of frontline workers are already seeing signs of a slowdown in their industry.

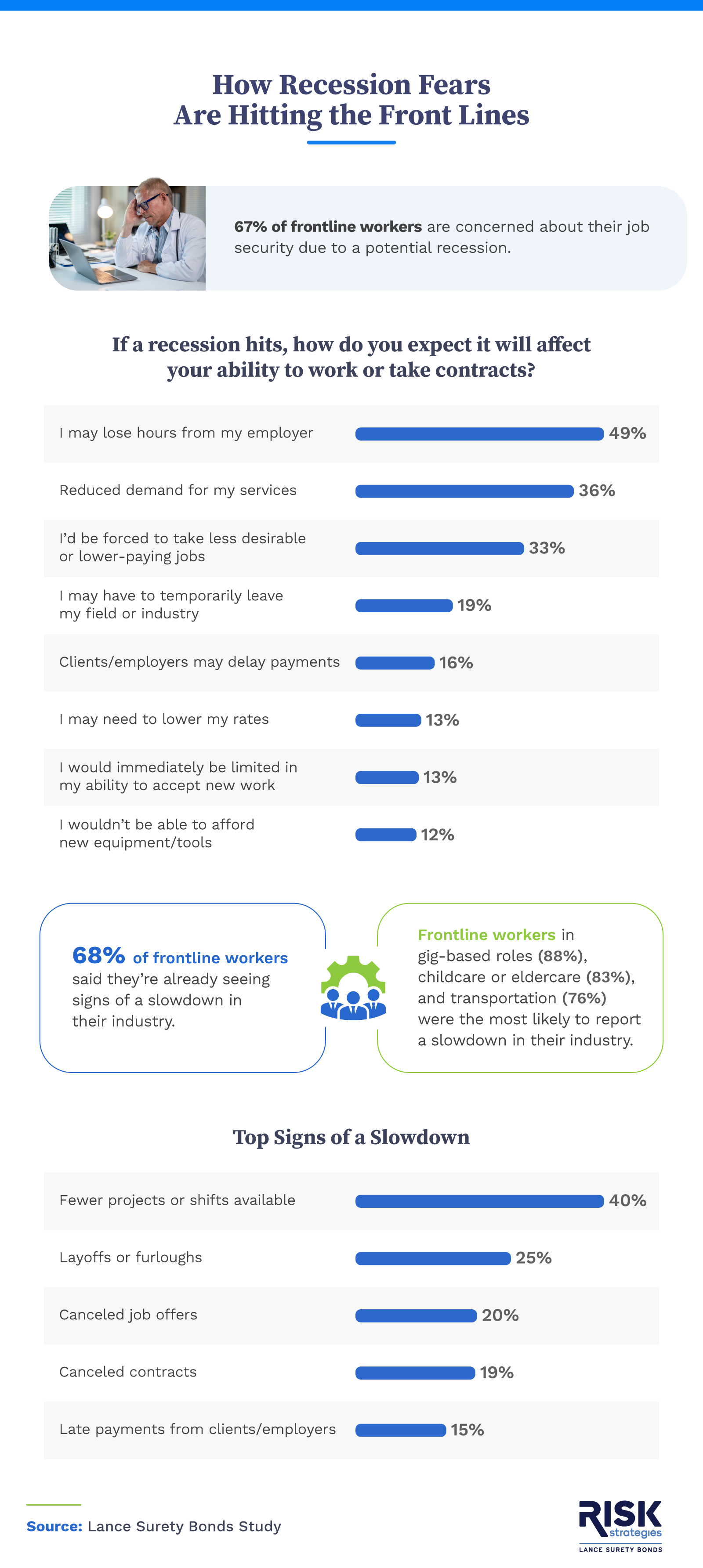

- 52% have picked up a second job to prepare for a downturn.

- Nearly 1 in 4 frontline workers (21%) are working at least 15 more hours per week across all their jobs — that's an extra 780 hours a year (roughly 97 full 8-hour workdays).

- 62% of frontline workers could financially survive for up to 2 months if they lost their main source of income.

- Half of frontline workers already believe the U.S. is in a recession, yet many say their employer hasn't acknowledged it.

Recession Worries Are Already Affecting Contractors

Frontline professionals aren't waiting for an official recession announcement. They're responding to warning signs in their industries right now.

More than two-thirds of frontline workers (68%) reported seeing signs of an economic slowdown in their field. Coupled with the fact that 67% were concerned about their job security, it's clear that anxiety over the economy is already shaping workplace dynamics.

These concerns are driving difficult decisions. A significant number have postponed key life events due to economic uncertainty. For example, 57% of frontline workers have delayed switching jobs, 48% have held off on medical or dental care, and 34% have paused plans to start a family. Over a third (34%) have decided not to retire yet, and the same number have chosen not to pursue further education.

As for their top financial fear, over half (57%) were worried about making rent or mortgage payments. Others feared they may lose their job (52%), take on debt (47%), or face reduced work hours (45%). More than 2 in 5 (43%) were concerned about being able to afford to feed their families, while 28% feared losing healthcare access.

Most frontline workers (86%) believe they will feel the economic pressure of a recession before white-collar workers do. Their real-time experience could offer an early glimpse of what's to come for the broader economy.

Preparing Their Wallets

In anticipation of tough times, many frontline workers are working more hours and doing more jobs to stay ahead financially.

To build a financial buffer, over half of respondents (52%) said they've picked up a second job. Nearly 1 in 4 (21%) said they're now working an additional 15 or more hours weekly, which is about 97 full 8-hour workdays over a year.

Still, most workers don't have much margin for error: 62% said they could only survive financially for up to two months if their main income disappeared. Gen Z workers were the most likely to say they could survive for this long (67%). They were also the most likely to have already made changes to their spending habits due to economic uncertainty (93%).

Even with efforts to prepare financially, many frontline workers are still struggling to make ends meet. Nearly 1 in 5 (18%) said they've taken on personal debt because of rising costs, reduced hours, or the need to cover basic expenses amid economic uncertainty. The average amount borrowed was $4,452, and nearly 1 in 6 workers said their debt exceeded $10,000.

Do Employers Have Their Back?

While frontline workers see economic troubles ahead, many feel their employers are not addressing their concerns.

Half of frontline workers said they believe the U.S. is already in a recession. However, many also shared that their employers haven't acknowledged a downturn or recession plans, creating a growing sense of disconnect between leadership and staff. This lack of recognition can make workers feel unsupported as they face increased workloads and financial stress.

Meanwhile, 33% of workers expect a recession to officially begin within the next year. With economic anxiety already affecting their decisions, many are hoping for more transparency and preparation from their employers in the months ahead.

The Front Lines of Economic Anxiety

Frontline workers are often the first to feel economic instability, and some are already taking action. From working longer hours to delaying life decisions, these professionals are bracing for impact. Whether or not the broader economy follows, their experiences offer an early warning and a powerful reminder of how vulnerable many Americans are when uncertainty strikes.

For frontline workers, now is the time to review your financial options, explore side income opportunities, and, if applicable, ensure your licenses and bonding requirements are in good standing to keep working legally. For employers, acknowledging workers' concerns and offering proactive communication or resources can go a long way toward building trust and resilience in the face of economic stress.

Methodology

We surveyed 844 frontline workers in April 2025 to explore how economic uncertainty due to a potential recession is shaping their work, finances, and expectations. Frontline workers in this study include individuals in trades, transportation, hospitality, healthcare support, retail, and other hands-on industries.

Among respondents, 88% were employees, 7% were self-employed, and 6% were independent contractors. The generational breakdown of respondents was as follows: Gen Z (18%), millennials (54%), Gen X (22%), and baby boomers (5%). Due to rounding, percentages in this study may not add up to 100% exactly.

About Lance Surety Bonds

Lance Surety Bonds helps entrepreneurs, contractors, and licensed professionals stay compliant and protected with reliable surety bonds. Whether you're starting a new business or preparing for a financial downturn, we make it simple to secure the bond you need. Explore our contractor license bonds and freight broker bonds to support your business goals.

Fair Use Statement

You're welcome to share these findings for noncommercial purposes. Just make sure to include a link back to this page and credit Lance Surety Bonds appropriately.

Get a FREE Surety Bond Quote in Minutes

- Fast and Secure Application

- Money Back Guarantee

- Approval in Minutes

- Nationwide Coverage

- Fast and Secure Application

- Nationwide Coverage

- Approval in Minutes

- Money Back Guarantee

- Image

- Image

- Image

Lance Surety Bond Associates, Inc. is a surety bond agency based out of southeastern Pennsylvania that is able to write all surety bond types in all 50 states. We are dedicated to servicing all of our customers' surety bonding needs throughout the country and guarantee competitive rates, timely responses, and unparalleled customer service.