What is a Surety Bond?

Surety bonds are a key part of many industries, ensuring that businesses and individuals fulfill their obligations. Whether required by law or contract, these bonds serve as a financial safety net, protecting consumers and government agencies from potential losses. But what exactly is a surety bond, and how does it work?

What Is a Surety Bond?

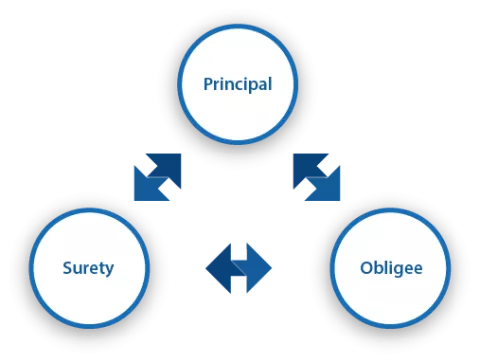

A surety bond is simply an agreement between three parties: Principal, Surety and Obligee. The surety provides a financial guarantee to the obligee (i.e. government) that the principal (business owner) will fulfill their obligations. Therefore, a surety bond is a risk transfer mechanism.

A principal’s “obligations” could mean complying with state laws and regulations pertaining to a specific business license, or meeting the terms of a construction contract, depending on the type of the surety bond.

If the principal fails to meet their agreed upon obligations with the obligee, the surety may be required to resolve the dispute by paying a claim to the obligee. It is in this sense that a surety bond is similar to a form of credit extended to the principal by the surety.

Three parties involved in a surety guarantee:

- PRINCIPAL: Individual or business required to post bond.

- OBLIGEE: Government entity, business of individual requiring principal to be bonded.

- SURETY: Provides financial guarantee to obligee on behalf of principal.

How a Surety Bond Works

A surety bond acts as a financial guarantee that ensures businesses and professionals meet their contractual or legal obligations. If the bonded party fails to fulfill their responsibilities, the surety company steps in to cover the loss—but unlike insurance, the bonded party must repay any claims.

Surety Bond Example

Let's say a roofing contractor is required to obtain a $50,000 surety bond to get a business license. The bond guarantees that the contractor will follow local building codes and complete projects as agreed.

If the contractor fails to finish a roof installation or uses substandard materials, the homeowner can file a claim against the bond. The surety company investigates, and if the claim is valid, they pay the homeowner up to $50,000 for repairs or hiring a new contractor. However, the roofing contractor is still responsible for reimbursing the surety company for the amount paid on the claim.

Who Needs a Surety Bond?

A surety bond is often required for individuals or businesses to ensure compliance with laws, protect consumers, or guarantee the fulfillment of contractual obligations. Some common groups that typically need a surety bond are:

-

Business Owners & Professionals

- Contractors & Construction Companies – Many states require contractor license bonds for general and specialty contractors.

- Auto Dealers – Must obtain a dealer bond to legally sell vehicles.

- Freight Brokers – Required to have a BMC-84 bond to operate legally.

- Mortgage Brokers & Lenders – Must secure a bond to comply with state regulations.

- Notaries – Some states require a notary bond to protect the public from errors or misconduct.

- Companies Bidding on Government Contracts

- Construction & Service Contractors – Performance and payment bonds ensure projects are completed as agreed.

- Vendors Supplying Goods/Services – Some government agencies require supplier bonds.

-

Businesses Handling Public Funds or Sensitive Information

- Credit Repair Services – Need a bond to operate legally in many states.

- Collection Agencies – Must have a bond to protect consumers.

- Money Transmitters – Ensures compliance with financial regulations.

- Court-Ordered Bonds

- Executors & Administrators – Probate bonds ensure proper handling of an estate.

- Guardians & Conservators – Required to manage finances for minors or incapacitated individuals.

- Appeal Bonds – Needed when appealing a court decision.

What Does a Surety Bond Guarantee?

For license & permit bonds, they guarantee that a principal understands and follows the regulations outlined for their specific license. This is where the term “license & bonded” comes from. Examples of a license violation could include fraud, misrepresentation, or late payment. If a covered violation causes a claim against the bond that the principal is unable to resolve, the surety will be required to pay the claim to the obligee.

In the construction industry, surety bonds typically ensure that a bonded contractor will fulfill their obligations specified in a signed contract. If a bonded contractor defaults on the contract, the surety guarantees that the obligee will be made whole. This can include either a financial payout or taking other actions to make sure the work is completed per the terms of the contract.

Types of Surety Bonds

As a crucial part of risk management, surety bonds are widely used across industries, from construction to finance, ensuring trust and accountability. By providing a layer of financial security and regulatory compliance, surety bonds help build trust and accountability in high-stakes transactions. Below are the main types of surety bonds.

License & Permit Bonds

You may be asked to post a surety bond as part of the licensing process to conduct certain businesses. Licensing authorities put these requirements in place to protect a licensee’s customers in case of misconduct or negligence. License & permit bonds may be required at federal, state or even municipal level.

Common examples of license & permit bonds include:

- Freight Broker Bonds

- Medicare DMEPOS Bonds

- Auto Dealer Bonds

- Freight Broker Bonds

- Contractor License Bonds

Contract Bonds

You’ll likely be required to be bonded when bidding for public or private work, namely in construction. Contract bonds are in place to ensure the bonded contractor fulfills its contractual obligations. Common types of contract bonds include:

Court Bonds

Court bonds are required in a variety of situations that can range from appeals to injunctions. They exist to protect vulnerable parties and to ensure the court’s rulings are followed. Some common types of court bonds include:

Fidelity Bonds

Fidelity bonds protect your customers from financial losses caused by your employees’ dishonest misconduct. Some common types of fidelity bonds include:

- Employee Dishonesty & Theft Bonds

- Business Services Bonds

- ERISA Bonds

- Janitorial Bonds

- Financial Institution Bonds

How Much Does a Surety Bond Cost?

The cost of a surety bond depends on several factors, including the bond type, amount, and the applicant’s credit score. Rather than paying the full bond amount upfront, businesses and individuals typically pay a premium, which is a percentage of the total bond value—usually between 1% and 10%.

Example Costs:

- A $50,000 contractor license bond with a 2% premium costs $1,000.

- A $10,000 auto dealer bond with a 5% premium costs $500.

Applicants with strong credit usually qualify for lower rates, while those with poor credit may face higher premiums or require collateral.

As a company specializing in surety bonds, we have firsthand experience helping businesses secure the right bonds at competitive rates. We guide our clients through the bonding process, ensuring they meet legal requirements while keeping costs manageable. If you need a bond, we can provide a free quote and personalized advice based on your specific needs.

How to Get a Surety Bond

Start by applying online with a licensed surety provider to receive a free quote. Your premium is based on your credit, with lower rates for strong credit profiles. Once approved, complete the application, make your payment, and receive your bond.

Secure your bond today with a seamless and efficient process!

How to Renew a Surety Bond

The surety bond renewal process begins when you receive an expiry notice, typically sent 30 to 90 days before the bond's renew-by date. Since sureties are not responsible for expired bonds, it's crucial to track your expiration date and start the renewal process early.

Expiry notices usually include a renewal quote, an invoice link, and any required forms. If you don’t receive these, contact your surety to initiate the renewal. Most renewals don’t require additional documents, but if there are changes to your bond, you may need to go through underwriting again, providing financial and business details.

Once you complete the forms and pay the renewal premium, your surety will issue the renewed bond. A digital copy is typically available within a day, while a hard copy and any necessary certificates will follow by mail.

What Happens If a Claim is Paid by the Surety?

As a bonded principal, you must take every action possible to avoid claims. Claim activity may happen in the process of conducting business, whether valid or invalid, but it is ultimately the responsibility of the principal to make sure the disputes are resolved prior to the surety paying out on a claim.

Before becoming bonded, you will be required to sign an indemnity agreement with the surety company where you must agree to pay the surety back if they have to pay a claim due a violation by your company. The surety is only extending your credit, and therefore will expect to be reimbursed if a valid claim is paid. Having a paid surety claim may make it very difficult for you to become bonded again in the future, as it is a standard question on all bond applications, and is usually a cause for decline.

Surety Bonds vs Insurance

A surety bond is not the same as traditional business insurance, though both provide financial protection.

Unlike traditional insurance, surety bonds act as a financial guarantee for the public or your customers, ensuring that your business fulfills its contractual or legal obligations. If you fail to meet these obligations, the surety company pays the claim, but you are required to reimburse them. While insurance protects your own business from financial losses due to accidents, theft, or liability claims. Unlike surety bonds, insurance spreads risk among policyholders and does not require repayment of claims.

NEW: Download our FREE ebook guide to learn all about the cost of surety bonds, regardless of which type of bond you're applying for!

About Us