Housing Crisis Impacts on Business Growth and Employee Stability

Rising housing costs are reshaping the way Americans think about work and what they expect from employers. For many employees, access to affordable housing is now tied directly to job decisions like relocation, in-office attendance, and long-term loyalty.

To understand how employer-backed housing benefits could influence business growth and workforce stability, we surveyed 800 employees and 200 employers across the U.S. This article breaks down which industries are offering housing perks, what workers are willing to trade for support, and why some companies are still hesitant to act.

Key Takeaways

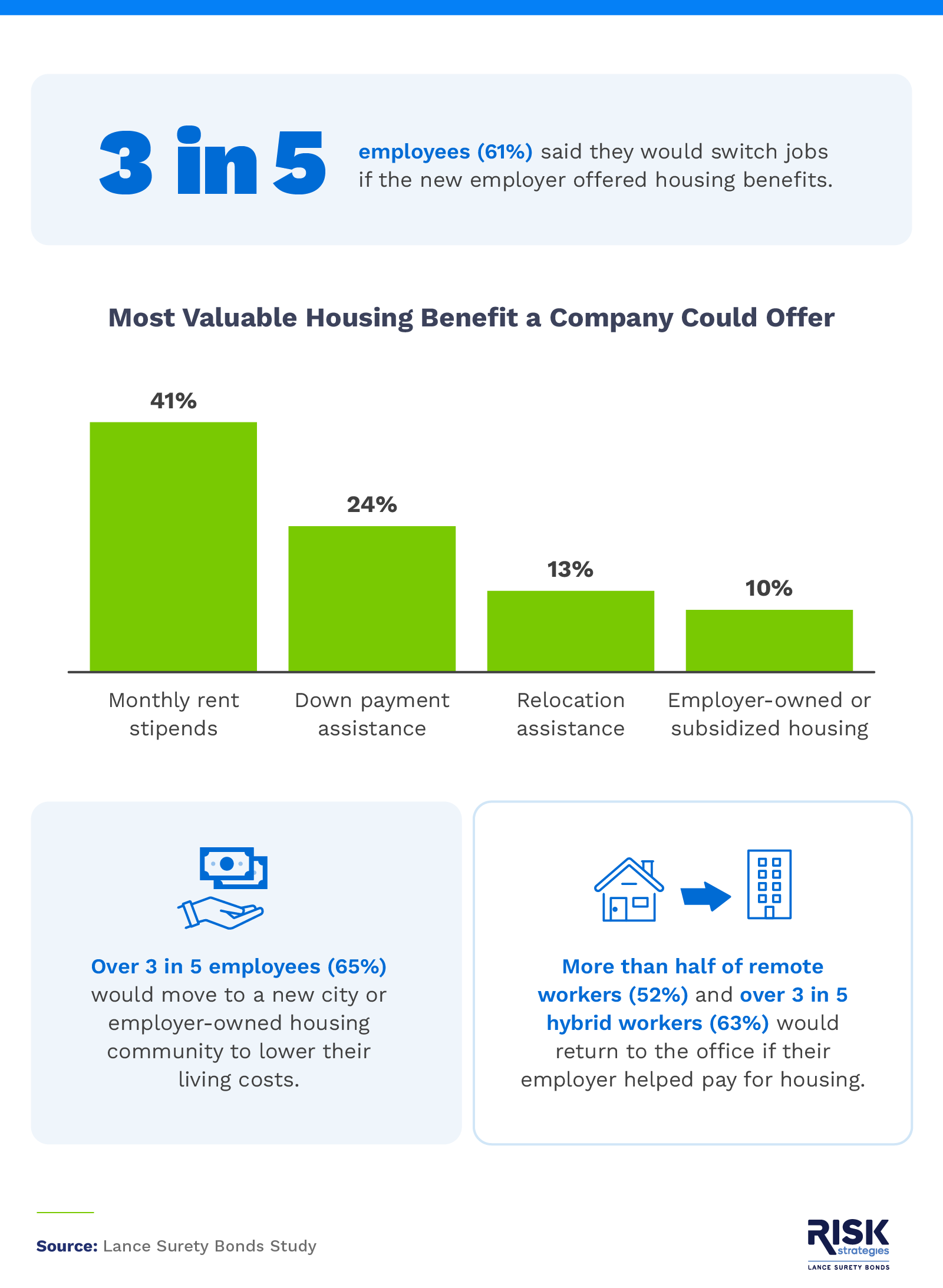

- 3 in 5 employees (61%) would switch jobs for better housing benefits.

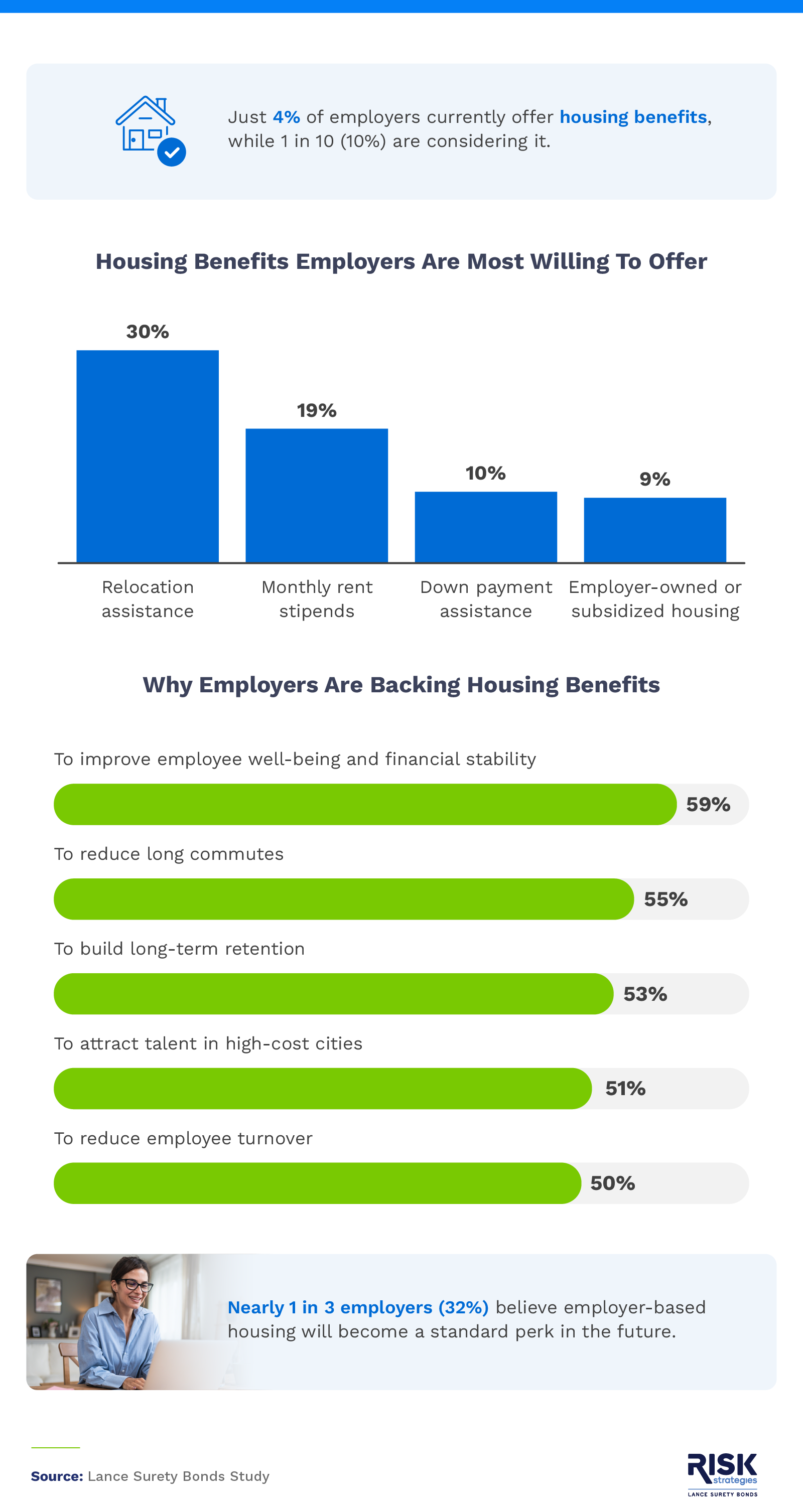

- 4% of employers currently offer housing benefits, and 10% are considering it.

- 38% of employees would take a salary cut for employer housing, giving up an average of 10%.

- 52% of remote workers would return to the office if their employer helped pay for housing.

- Over 1 in 4 would sacrifice their PTO for housing benefits.

- Housing costs have kept 42% of employees from accepting better job offers elsewhere.

Why Younger Workers Want Housing Help and Which Industries Are Listening

Employee housing benefits are gaining attention as a way to support workforce stability, especially among younger generations. We looked at which industries are leading the way and how workers across age groups feel about housing support from their employers.

As housing costs climb, employer-provided housing benefits are emerging as a strategic advantage in recruitment and retention. About 1 in 3 employees (31%) believe housing benefits will become a standard job perk within the next decade.

More than 2 in 5 employees (42%) said high housing costs have stopped them from taking better jobs elsewhere. Top concerns about relocating for work included moving expenses (36%), uncertainty about housing availability (36%), and a higher cost of living (35%). A majority of employees (86%) agreed that housing support could help companies attract or retain skilled workers in expensive cities.

One in 10 employees said their company currently offers housing benefits, with another 9% reporting that their employer is considering it. Industries most likely to provide housing perks include tech, marketing, and legal, where competition for top talent is high.

Younger workers showed the strongest interest in housing support. Over 3 in 5 Gen Z (69%) and millennial employees (62%) said they would switch jobs if the new one came with housing benefits, compared to 54% of Gen X and 46% of baby boomers. Gen Z workers (75%) were also the most willing to move to lower their living costs, followed by millennials (64%), baby boomers (63%), and Gen X (61%).

Among remote employees, more than half of Gen Z (57%) and millennials (54%) said they'd return to the office if employers helped cover housing costs. And across all employees surveyed, half said employer housing assistance could help them transition from renting to owning a home.

Why Some Employers Hesitate To Offer Housing Support

Employers are weighing the pros and cons of offering housing benefits as a tool to attract and retain employees. While some see strategic value, others remain hesitant to adopt these perks.

Finance, tech, and healthcare are the industries most likely to offer or consider offering housing benefits, but overall adoption remains limited. According to employers, just 4% currently provide housing perks, and 1 in 10 said they're considering it. Still, nearly 1 in 3 employers (32%) believe housing assistance could become a standard workplace benefit in the future.

Cost is the biggest roadblock. More than half of employers (56%) said housing support is too expensive to implement. Others pointed to concerns over long-term commitments (49%) and legal or compliance risks (41%). Over 1 in 3 employers (35%) said they would consider offering housing support instead of a salary increase, but only if the employee agreed.

Despite the hesitation, some employers see strategic potential. Nearly 1 in 3 (31%) believe housing perks are more cost-effective than raising wages. And 25% said high housing prices have already made it harder to hire or retain employees — a figure that rises to 40% for companies located in high-cost cities.

What Employees Are Willing To Sacrifice for Housing Support

Housing affordability continues to shape career decisions, from whether to relocate to what benefits matter most. We asked workers what they'd be willing to trade in exchange for employer-backed housing support.

When asked to choose between a $5,000 raise, employer-assisted housing, or unlimited PTO, most employees (61%) chose the salary increase. But 25% preferred housing support, and 13% opted for no limits on their paid time off. Younger workers showed the strongest Interest in housing perks, with 29% of Gen Z employees and 26% of millennials saying they would take housing assistance over the raise.

Many employees are also open to more direct trade-offs. Nearly 2 in 5 (38%) said they'd take a pay cut for employer housing and were willing to give up 10% of their salary, on average. About half of Gen Z (52%) and baby boomers (50%) said they would accept a pay cut for free or subsidized housing, compared to just 37% of millennials and 28% of Gen X.

Employer Housing Benefits Could Be the Next Big Workplace Shift

As housing pressures continue to influence the labor market, employer-based housing benefits are becoming harder to ignore. Many workers, especially younger generations, are willing to relocate, return to the office, or even take a pay cut for better housing support. While some employers remain cautious, a growing number see these benefits as a cost-effective way to attract and retain talent. The conversation around housing and work is no longer just personal — it's becoming a business strategy.

Methodology

We surveyed 800 American employees and 200 American employers to explore how employer-based housing benefits could impact business growth, employee retention, and workforce stability. Among employees, the average age was 38; 44% were female, 55% were male, and 1% were non-binary. Generationally, 3% were baby boomers, 22% were Gen X, 59% were millennials, and 16% were Gen Z. Among employers, the average age was 44; 53% were female, 46% were male, and 1% were non-binary.

About Lance Surety Bonds

Lance Surety Bonds is a nationwide provider of surety bond solutions for businesses and individuals navigating regulatory requirements. We specialize in license and permit bonds, including contractor license bonds and mortgage broker bonds, to help clients stay compliant with state and industry regulations. Our fast, expert service and streamlined online application process make it easy to secure the right bond quickly.

Fair Use Statement

Noncommercial use of this content is permitted if proper attribution is provided via a link.

Get a FREE Surety Bond Quote in Minutes

- Fast and Secure Application

- Money Back Guarantee

- Approval in Minutes

- Nationwide Coverage

- Fast and Secure Application

- Nationwide Coverage

- Approval in Minutes

- Money Back Guarantee

- Image

- Image

- Image

Lance Surety Bond Associates, Inc. is a surety bond agency based out of southeastern Pennsylvania that is able to write all surety bond types in all 50 states. We are dedicated to servicing all of our customers' surety bonding needs throughout the country and guarantee competitive rates, timely responses, and unparalleled customer service.