Inflation Reduction in 2025: Business and Consumer Perspectives

How are Americans and business leaders responding to projections that inflation may go down? As the economy changes, people and companies adjust their spending and saving strategies, reflecting a mix of optimism, caution, and strategic planning. This article explores how possible inflation relief is shaping consumer and business behavior in 2025. You'll learn about Americans' evolving spending habits and shifting savings and investment priorities. We also cover businesses' planned operational changes, investment strategies, and hiring practices. Find out how inflation reduction could impact financial decision-making across the country.

Key Takeaways

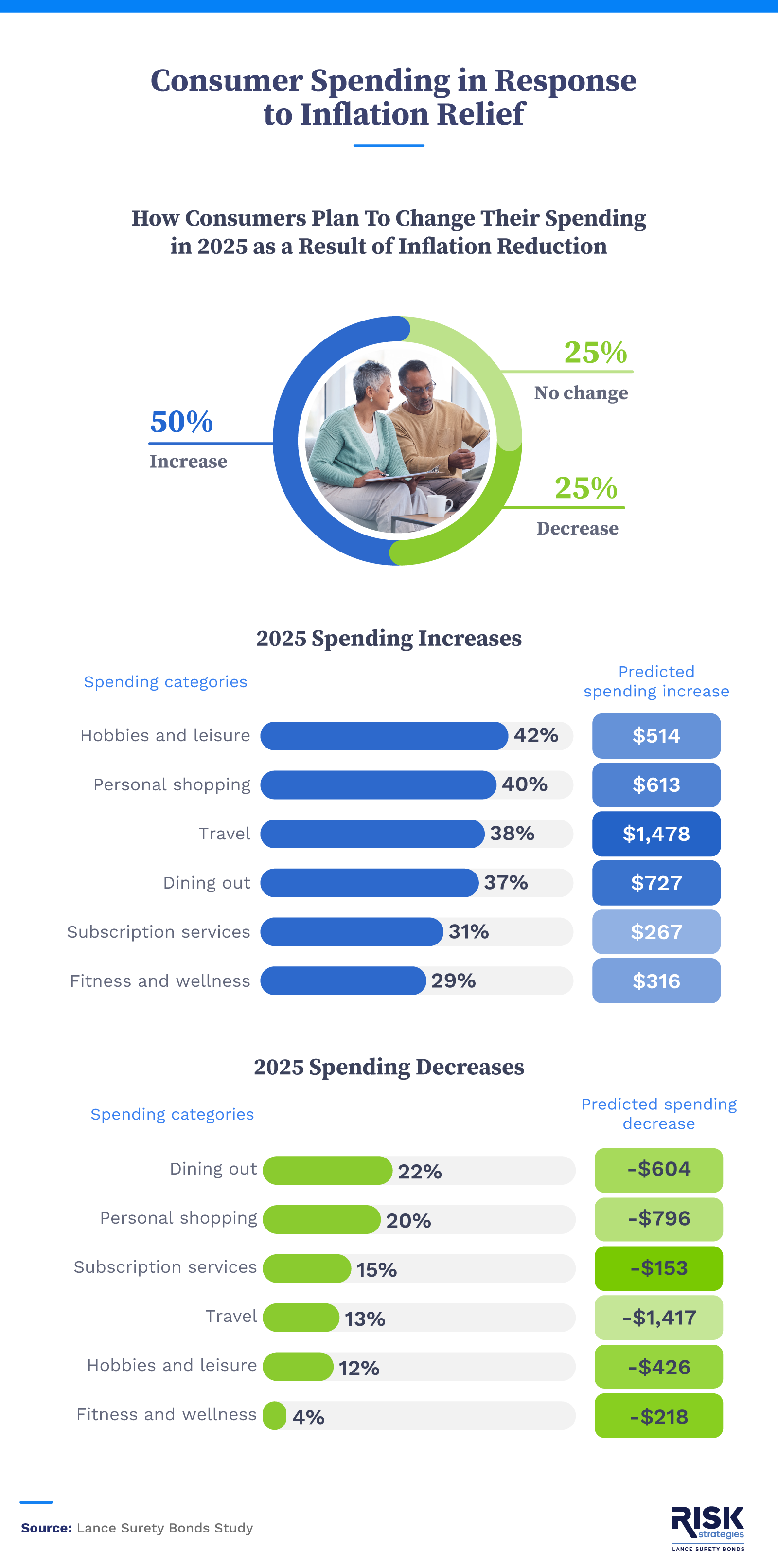

- 50% of Americans plan to increase their spending in response to the anticipated inflation reduction, while 25% plan to decrease spending.

- Those planning to increase their spending are most likely to do so for hobbies and leisure; among those planning to decrease their spending, they are most likely to do so for dining out.

- 54% of Gen Z plan to increase their travel spending in response to inflation reduction.

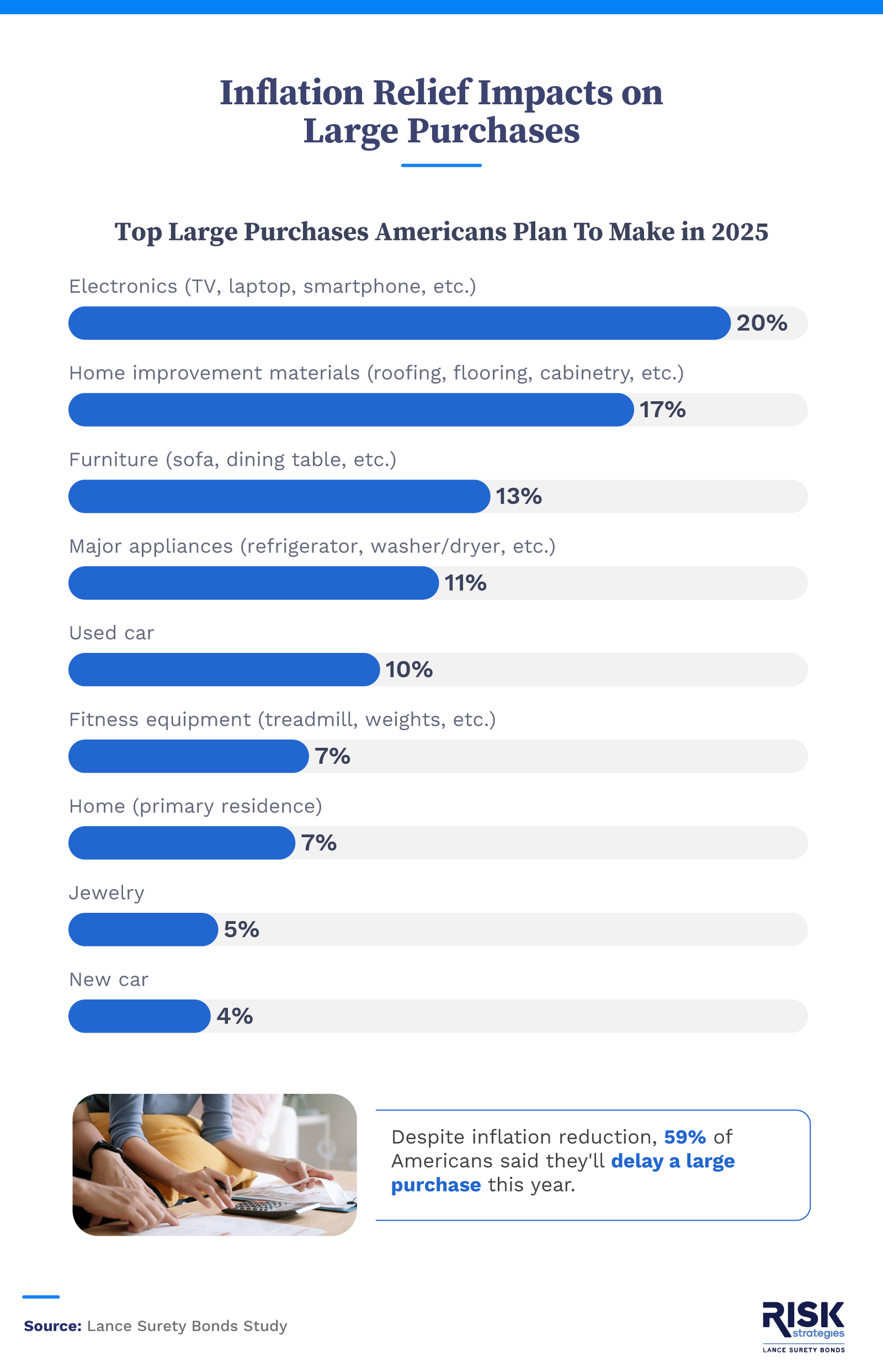

- Despite inflation reduction, 59% of Americans will delay a large purchase this year.

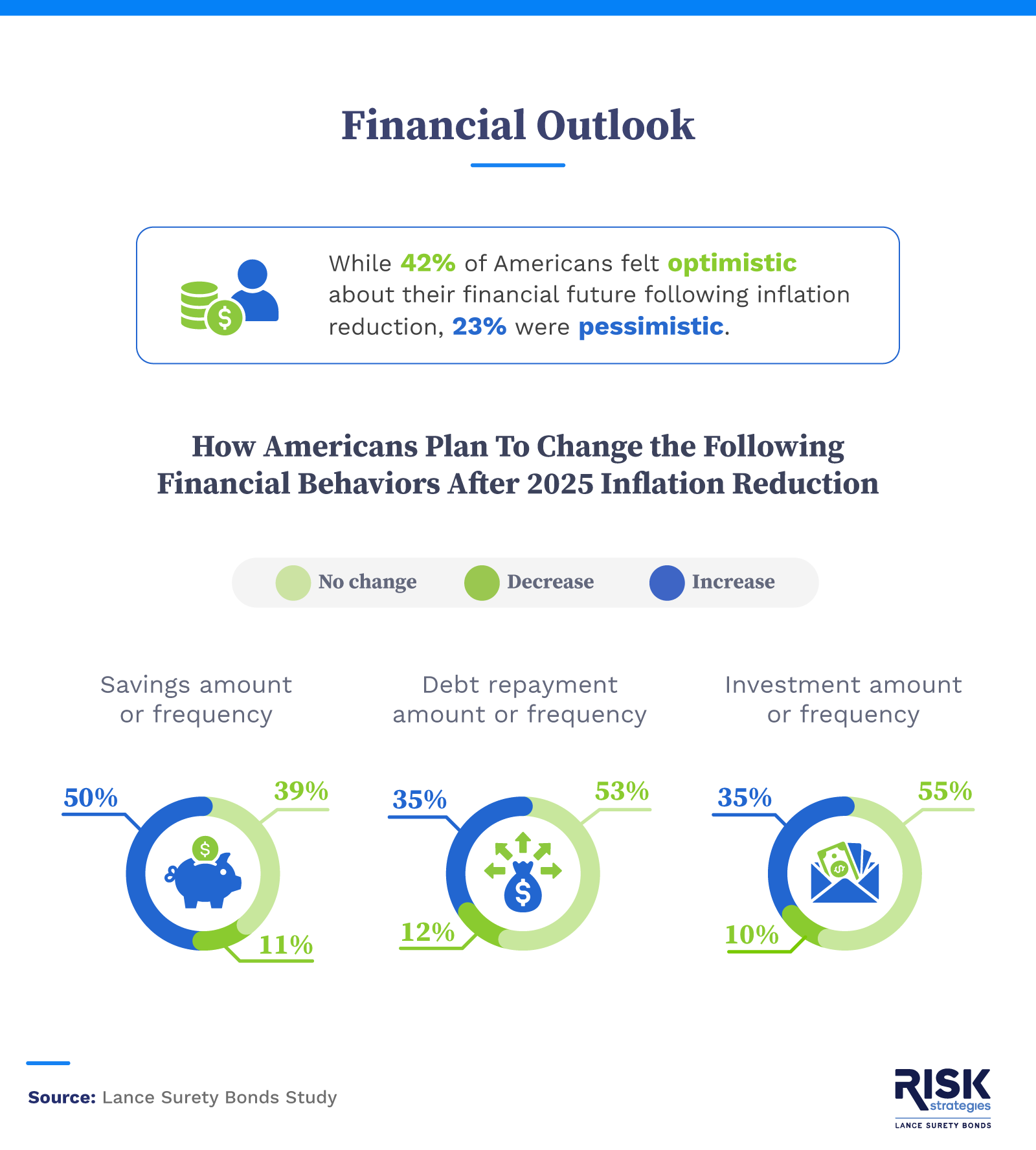

- 42% of Americans feel optimistic about their financial future following inflation reduction, especially Gen Z (63%).

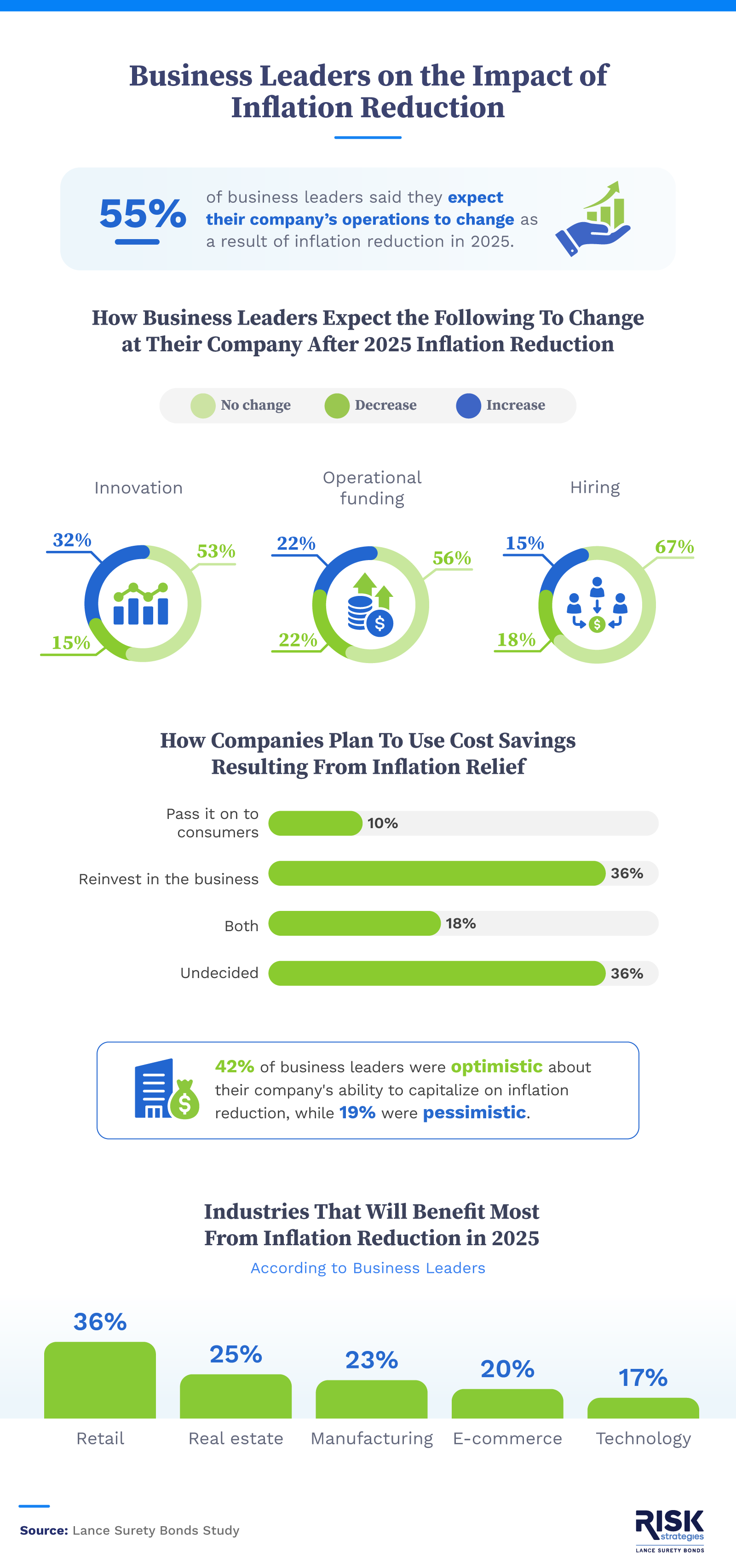

- 42% of business leaders are optimistic about their ability to capitalize on inflation reduction.

- Just 10% of business leaders plan to pass their company's cost savings from inflation reduction along to consumers.

Americans' Spending, Saving, and Financial Outlook Amid Inflation Relief

A possible inflation reduction is significantly influencing Americans' financial decisions. This section explores how Americans are adjusting their financial behavior — spending intentions, delayed purchases, and steps toward savings and debt repayment — along with their overall outlook on the future.

Half of Americans planned to increase their spending in response to inflation relief, while 25% intended to cut back. Gen Z was the most likely to increase spending (57%), whereas Gen X was the most likely to decrease it (29%).

For those increasing spending, hobbies and leisure were the top priorities. Gen Zers in this group were particularly inclined to spend on travel, with 54% naming it their top category. Conversely, dining out was the most common expense to see cuts among those planning to reduce their spending.

Electronics, home improvement materials, and furniture topped the list of large items Americans planned to buy in response to inflation relief. Gen Z was the most likely to say they'll make at least one big purchase, with 72% expressing intent to do so.

Notably, 15% of Gen Z was planning to purchase a primary residence as a result of inflation relief. Although immediate relief in housing costs is expected, concerns remain about a potential resurgence in housing inflation due to supply constraints, with experts warning of inherent inflationary pressure in the long run.

Many other Americans said they'd hold off on major purchases. Despite possible inflation reduction, 59% of respondents said they'd delay a large purchase this year. Gen X was the most likely to take this cautious approach, with 62% postponing big spending decisions.

While 42% of Americans felt optimistic about their financial future following an inflation reduction, 23% were pessimistic. Gen Z was the most optimistic, with 63% expressing a positive outlook. Other research reflects this as well: Despite financial frustrations and uncertainties, 43% of Gen Z remain hopeful about their financial prospects overall. Meanwhile, we found Gen X to be the least optimistic about it in light of potential inflation reduction (32%).

Many Americans were planning proactive steps to strengthen their financial footing. Half intended to increase their savings (either in payment amount or frequency), while 35% planned to increase their debt repayment or investment efforts.

Inflation Reduction's Impact on Business Strategies

Anticipated inflation relief is driving changes across businesses, with leaders adapting strategies for operations, investments, and workforce management. This section examines how companies of different sizes and industries are responding to these economic shifts.

More than half of business leaders (55%) expected their operations to change as a result of a potential inflation reduction. Leaders at large companies (with 200 employees or more) were the most likely to foresee changes (59%), while those at micro companies (with 1-10 employees) were the least likely (52%). Innovation was a key focus, with 32% of business leaders believing inflation relief would increase their ability to innovate. E-commerce and technology leaders were especially optimistic about this, with 42% in each sector expressing this view.

Investment plans reflected uncertainty, as 22% of business leaders believed inflation relief would either increase or decrease their operational funding. Leaders of small companies (having 10-50 employees) were more likely than those of other business sizes to say they'd invest more in their operations (31%). Business leaders in e-commerce were also likelier than those in other sectors to say this (32%).

Hiring practices showed a mixed outlook: 15% of business leaders expected their hiring to increase if there's an inflation reduction, while 18% anticipated a decrease. Medium-sized companies (with 50-200 employees) were the most likely to plan increased hiring (24%), whereas large companies (of 200 or more employees) were the most likely to reduce it (31%).

Tech business leaders stood out, with 25% planning to increase hiring. This aligns with other predictions for the tech job market in 2025, which anticipate renewed growth and increased demand for AI engineering roles.

In terms of cost savings from inflation relief, only a small 10% of business leaders planned to pass the savings on to consumers. Another 36% intended to reinvest the savings into their businesses, and 18% intended to do both.

Adapting to Inflation Relief

Inflation relief could transform financial behavior among America's consumers and businesses. They are adjusting their spending and savings priorities, balancing optimism about their financial futures with caution toward major purchases. Meanwhile, many businesses are set to reevaluate operations, investment strategies, and workforce planning in response to these economic changes. Gen Z may spend more on travel as a result of inflation reduction while many business leaders will likely reinvest their savings into innovating their operations.

If inflation eases, individuals and companies alike could have an opportunity to align their financial goals with emerging opportunities.

Methodology

For this study, we surveyed 501 consumers and 500 business leaders to understand how the anticipated inflation reduction would impact their spending habits and business operations, respectively.

About Lance Surety Bonds

Lance Surety Bonds provides fast, reliable surety bond solutions for businesses and individuals across industries. We offer a broad range of bonds to support businesses in meeting regulatory requirements and ensuring financial accountability, from Contract License Bonds to Mortgage Broker Bonds. Whether you’re a business leader planning operational changes or an entrepreneur navigating new opportunities, our knowledgeable team and streamlined bonding process make securing the right bond simple and hassle-free.

Fair Use Statement

Sharing this data for noncommercial purposes is welcome, but a link to our source must be included.

Get a FREE Surety Bond Quote in Minutes

- Fast and Secure Application

- Money Back Guarantee

- Approval in Minutes

- Nationwide Coverage

- Fast and Secure Application

- Nationwide Coverage

- Approval in Minutes

- Money Back Guarantee

- Image

- Image

- Image

Lance Surety Bond Associates, Inc. is a surety bond agency based out of southeastern Pennsylvania that is able to write all surety bond types in all 50 states. We are dedicated to servicing all of our customers' surety bonding needs throughout the country and guarantee competitive rates, timely responses, and unparalleled customer service.