1. Start Your Application

2. Receive Your Free Quote

3. Buy Your Surety Bond

- Experts in bonding Freight Brokers

- Lowest rates in all 50 states!

- Get approved in just minutes!

- Bad credit? No problem!

Who We Are

Lance Surety Bond Associates is a surety bond agency that is able to write all surety bond types in all 50 states. We are dedicated to servicing all of our customers' surety bonding needs throughout the country and guarantee competitive rates, timely responses, and unparalleled customer service. We're able to write all types of contract and commercial bonds, utilizing a state-of-the-art online application system for all commercial bond types, making the application process fast and easy. Most bonds are instantly approved online!

Through our vast network of markets, we can offer customers a number of specialty programs for certain bond types including mortgage broker bonds and auto dealer bonds. Additionally, we have exclusive programs that can assist customers with poor credit in getting the bonds they need.

Need more information? We're happy to help. Call us at 877.514.5146

Frequently Asked Questions

It's FREE. No Obligations. Approval in Minutes.

What Our Clients Say About Us

It's FREE. No Obligations. Approval in Minutes.

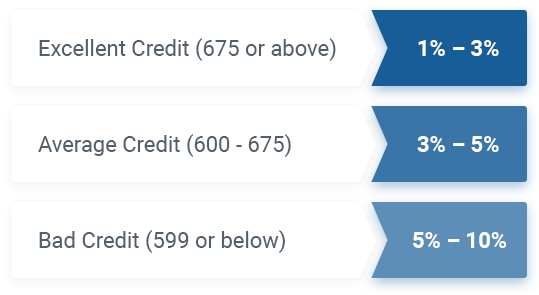

Annual premium for the $75,000 BMC-84 Bond currently range between $1,300 and $9,000. If this sounds too much for you, Lance Surety Bonds also offers exclusive payment plans. To get a free quote and to learn more about possible payment plans, fill out the

Annual premium for the $75,000 BMC-84 Bond currently range between $1,300 and $9,000. If this sounds too much for you, Lance Surety Bonds also offers exclusive payment plans. To get a free quote and to learn more about possible payment plans, fill out the